Budgeting Problems in 2024

I get it, it’s challenging to have a budget, nonetheless, stay on track with it! My husband and I got married in 2020 and in the last four years, the world has changed astronomically. The huge inflation in groceries, bills, and mortgages hasn’t been easy to juggle. Living costs a lot.

So often a budget seems to be the problem. It’s uncomfortable, it’s limiting, it’s never enough. I get it, I’ve heard all of those things and have also spent my fair share of time bemoaning those very issues. Regardless of how much money is made during the month, separating it all into a budget can be one of the most aggravating and discouraging things to do as it seems to disappear way faster than it was accumulated.

My husband and I have struggled to make and stick to a budget that fits our needs. However, last fall, we ran across a new method of budgeting that has been lifechanging for us!

Budget Resources

Bill and Linda Lotich wrote a book a few years ago, that my husband and I invested in last Autumn in an effort to get on the same page with our spending. Check it out here at https://seedtime.com/smrl/.

Simple Money Rich Life proved to be exceptionally well written, and the encouragement that came from observing two different people (Bob and Linda), with two unique spending needs and habits get on the same page about their financial life was incredibly rewarding!

After reading that book, we were challenged to take a look at our differences and similarities. The financial incentives that we had uniquely were quite different. My husband thrives on saving. He penny pinches right and left and rewards himself, after several long months or a year, with one very large purchase rather quickly! I like LOTS of little purchases along the way, and I am especially driven by gift-giving. Talking about money together used to stress me out!

I assigned the budgeting to my husband and would cringe anytime he wanted to talk about it with me. I constantly felt like a failure, and he was regularly discouraged due to our lack of a united front on this issue. So, we finally decided to try something different.

It takes two to Tango!

We split the budget responsibilities. It just so happened that about the same time that my sister texted me and asked if she could pick up a “squishy folder” from Staples for me! “YES!” I texted back! “Please do!”

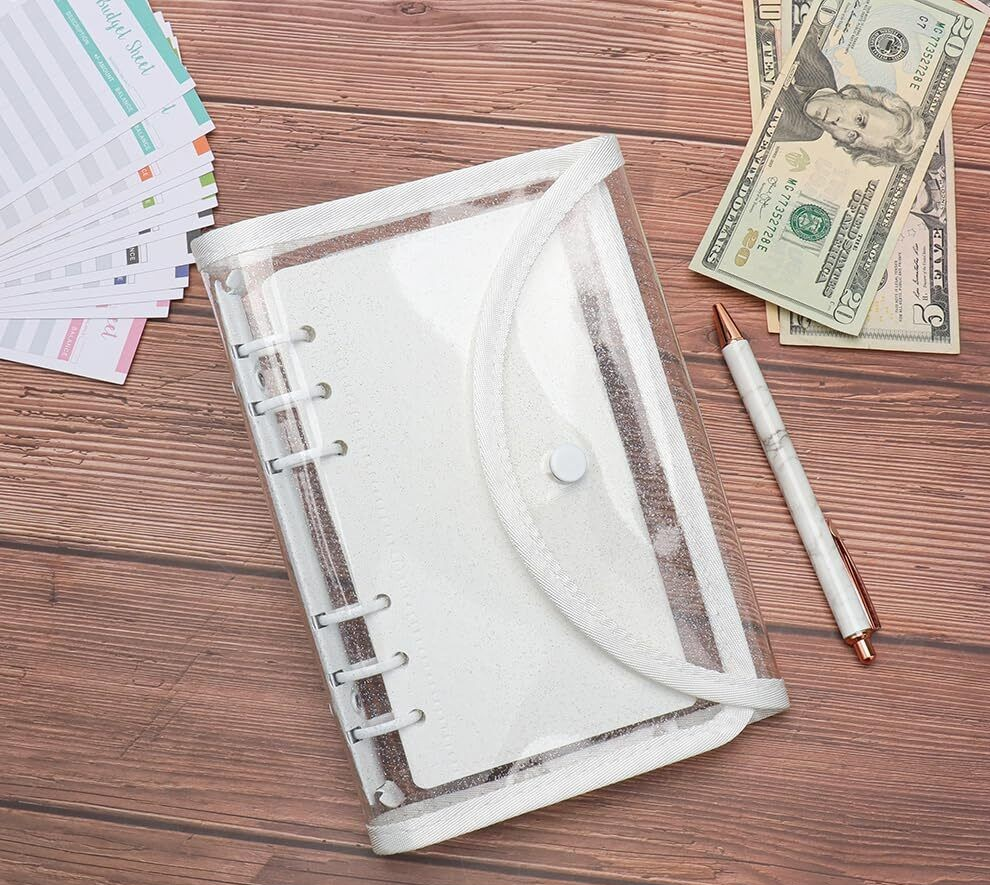

The squishy folder looked something like this one, and you can find ones like it on Ebay, Amazon, or at Staples.

Budget Solution – It Takes 2 to Tango!

We were curious to see how splitting the budget might work and that curiosity led to one of the best decisions of our married lives. We chose to split our budget into two categories. My husband took over the management of about $600 dollars, which totaled the monthly amount of bills that we had set up as “auto pay” transactions in our bank account. It is his job to monitor those and maintain them. Those include, car insurance, phone bill, credit card payment (we pay it off each month), and the like.

I manage $840 dollars each month. I pull this total out of our account after getting paid at the beginning of each month! This cash goes into my “squishy folder” for the month’s necessaries. It is split between fuel, groceries, miscellaneous, toiletries, diapers and wipes, clothing, gifts, propane for our BBQ, our quarterly Costco trip, vacation savings, and more.

This method has allowed us to save literally hundreds of dollars a month! Our take home income far exceeds the $1400 and change that we have allotted to bills and necessary expenses. However, we are completely comfortable with our current budget and BEYOND thrilled to finally see our savings accounts growing by the hundreds. In about 6 months, three individual areas of savings had already grown to over a thousand dollars, just from this little hack!

Budget – Final Thoughts

One last thing that we have successfully implemented is the process of automation! Bill and Linda Lotich, in their book, Simple Money Rich Life, outline an excellent method for this. We followed suit and set up automatic payments, not just for bills, but for each of our savings’ categories!

It doesn’t sound like much, but that little step in conjunction with the budgeting method we implemented is worth its weight in gold!

Happy Budgeting!

Lyssa

Check out more from me at http://www.purposefullyput.com.

Leave a Reply